Loan Policy

Scottish Universities Community Bank

Registered as First Scottish University Credit Union Ltd

Loan Policy

Purpose

This policy ensures that the Credit Union follows rules so that the process of making

loans to members is fair and equitable. Scottish Universities Community Bank is a

responsible lender. We give every loan application we receive careful consideration

and decide based on the income and expenditure and overall ability to repay the

loan. We have a duty to each loan applicant to ensure that any loan approved does

not result in financial difficulties and hardship. We also have a duty of care to the

entire membership ensuring no undue risks are taken with their savings.

It is important to highlight that as a financial organisation we reserve the right to

decline certain applications. A loan refusal simply means that on this occasion we

feel unable to offer the amount of loan that has been requested. In some

circumstances, we may offer a reduced amount.

The Credit Union adheres to the requirements of the Prudential Regulation Authority

(PRA), which regulates Credit Unions. The Credit Union will review how to apply

these requirements as the PRA changes them. The PRA has set a maximum loan

period of 60 months for repayment of credit union loans. The PRA has set a

maximum loan interest rate of 3% per month (42.6% APR) on loans made by credit

unions.

General Information

- Eligible members may apply for a loan at any time. The eligibility terms

are as follows.

i. Members must be at least 18 years of age.

ii. Members must reside in the UK.

iii. The member is not currently in arrears with the credit union.

iv. New members and first-time borrowers of the credit union are eligible to apply for an Introductory Loan.

v. Current and previous borrowers are not eligible to apply for an Introductory Loan.

vi. Members with an outstanding Introductory Loan do not qualify for further lending until the settlement of the Introductory Loan. Scottish Universities Community Bank Loan Policy

vii. The applied value of all loans, excluding Introductory Loans, can be up to five times the value of the member’s savings value. E.g £1000 savings = £5000 lending. Existing members can apply for lending up to £15,000 plus their share value.

viii. Existing borrowers are eligible to apply for a top-up loan. The eligibility terms of top-up loans are as follows.

– The Credit Union has made no more than two advances without receiving full repayment of the loans

ix. Applicants must not be in an active IVA, DAS, Protected Trust Deed, Bankruptcy, or other Judgements. - All loan applications will require 2 recent payslips and 2 recent bank statements.

- The Credit Union will require members to enter into an agreement to repay their loans in full according to a specified schedule of payments of

interest and capital, which the Credit Union will give the member before completing any loan agreement. - Interest rates on loans are advertised on our website and are subject to change.

- Outstanding interest on loans will be calculated monthly on the reduced balance.

- The Credit Union will require all members entering into a loan agreement to make monthly share deposits of £10 minimum.

- Credit Union will refuse any request to withdraw shares which would mean the value of a member’s shares would be less than the current value of any outstanding loans.

- SUCB loans incur no fee or penalty for early settlement.

- Additional payments to a member’s loan balance can be made at any time.

Employer Restrictions

- A loan term cannot exceed a date beyond the end of a member’s employment contract end date.

Refusal

- When the Credit Union decides that it cannot make a loan to a member on the terms originally requested it will explain to the member the

reasons for its decision. - A rejected application does not debar a member from applying for a loan in future.

- Members can ask for a review of a rejected loan application by another member of staff. Members have 14 days from the day of refusal to ask for a review

Loan Non-Repayment

- Where any member believes they will not be able to make scheduled loan payments, and/or should the member be in danger of entering financial difficulties, the member should contact the Credit Union as soon as possible to discuss their situation.

- The Credit Union will seek to agree to an amended payment schedule with any member who cannot keep to the scheduled repayments in the original loan agreement.

- Under any revised repayment schedule, the Credit Union shall seek full repayment of the loan.

- In the event of a member breaking a loan repayment agreement, the Credit Union will take reasonable steps to pursue outstanding debt, see the SUCB Credit Control Policy for these steps.

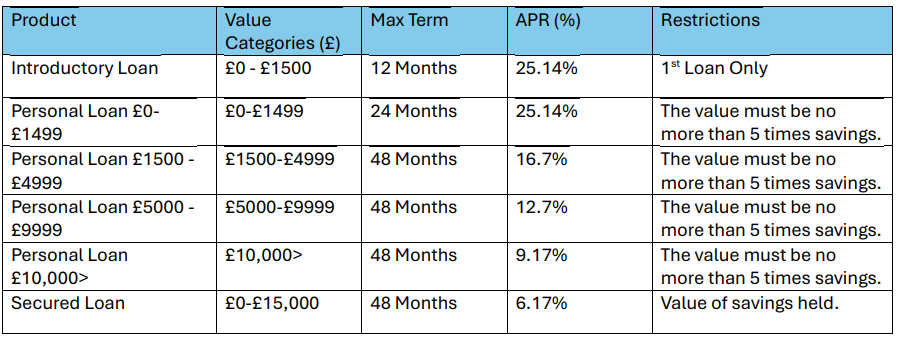

Loan Products

Loans for Staff, Directors, and Volunteers

- All loan applications for staff, directors and volunteers must be underwritten by 2 people involved with the community bank.

- If a staff member applies a member of the board or a volunteer must be the second underwriter of the application.

- This information must be documented via the loan application notes.

- The supervisory committee must be notified of all loans to staff, directors, and volunteers within 14 days of approval

Policy Review

- This policy will be reviewed annually or as required to ensure it remains in line with organisational needs and financial regulations.

Version – October 2024

Date Updated – 01/10/24

Board Approval Date – 29/10/24

Review Date – 29/10/24

Signed – CEO